Risk Exposure Management

| Overview | Solution | value to you | Next Steps |

Insurance carriers need an improved understanding of risk to manage their exposure

Better understand risk factors

.png) | Superstorm Sandy increased the need for location intelligence and decision support. PropertyCasualty 360 |

| The ability to identify, assess and manage risk is often indicative of an organization’s ability to respond and adapt to change. PricedWaterhouseCoopers |

| Unable to depend on investment income, carriers have been playing closer attention to underwriting and raising prices for coverage accordingly. Deloitte Center for Financial Services |

Better understand real-time PML from all disasters

| Volatility in weather patterns increases potential for claims losses and reduced profits. Ernst & Young |

| Insured value of properties in coastal U.S. counties is now greater than $10.64 trillion. AIR Worldwide Corp. |

| Meteorologist predict more active hurricane seasons over the next few years. NOAA |

Improve risk assessments and policy pricing

| Financial and economic upheavel has produced volatile investment returns and price-sensitive customers. Strategy Meets Action (SMA) |

| Difficulty in measuring the company’s current exposure to catastrophes threatens profitability, financial viability, and customer retention. American Academy of Actuaries |

| Insurers are faced with the on-going inability to accurately forecast the cost or exposure of new risks. Deloitte Center for Financial Services |

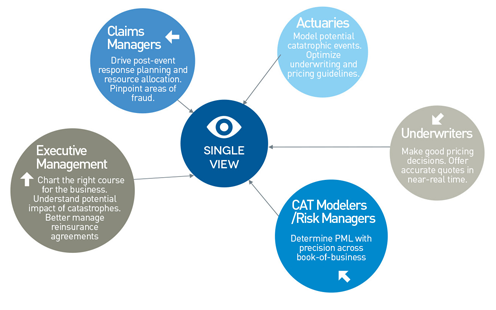

A single view of risk can help drive competitive advantage

A complete geographic risk analysis solution providing insight into individual and aggregate exposure from catastrophic natural or man-made disasters in a near-real time manner.

Insurance carriers need an improved understanding of risk to manage their exposure

We offer a complete geographic risk analysis solution providing insight into individual and aggregate exposure from catastrophic natural or man-made disasters in a near-real time manner.

Capabilities include:

- Geographical analysis and visualization of risk across the enterprise

- Understanding of near-real time exposure and impact of catastrophe on the insurer’s book of business

- Compliance with new risk management legislation/regulations

Insurance carriers need an improved understanding of risk to manage their exposure

Carriers are beginning to leverage technology solutions for a comprehensive risk management solution – one that helps carriers overcome siloed operational structures, IT systems and data sources to integrate information across the enterprise, ensure its quality, enrich it with third-party data – and then present a single, map-based view of operational risk in near-real-time.

Underwriters, CAT Modelers, Actuaries and other executives will be able to:

- Increase their understanding of a policy in context to the company’s book of business

- Better understand probable maximum loss to evaluate the impact of a catastrophe their business

- Provide a near-real time perspective on the company’s exposure

- Allocate post-CAT event resources

- Enable distribution analysis for overexposed concentration of risk

Validation

.png) | "By increasing the locational accuracy, our catastrophe modeling can now produce more precise results and risk estimations for a myriad of potential perils. The improved insight and risk reporting capabilities are also helping to address EU Solvency II regulatory requirements." Nigel Davis |

| "Visualizing this important information on a map makes a world of difference…[In the past] it was difficult for our underwriters to avoid inadvertently insuring too many properties within close proximity. With MapInfo Professional ® , the exact location of a property is visually depicted so we avoid such mistakes." Brian Haney |

Our solution helps you identify, assess and monitor risk from the individual policy level to your aggregated book of business; it combines data management, best-in-class geocoding, address validation, data quality, data enrichment, and visualization in a single platform; and it enables you to make better operational and strategic decisions across your organization – from actuarial, underwriting, CAT modeling, risk management and distribution/marketing to executive management.

Key Recommendations:

- Adopt an “Enterprise Data Strategy” to break down legacy siloes and leverage data across multiple lines of business.

- Adopt an “Enterprise Data Strategy” to break down legacy siloes and leverage data across multiple lines of business.

- Leverage GIS analytics and visualization technologies to gain greater insight into risk exposure and CAT Management.

| A Single View of Risk – From the Policy to Complete Book of Business Understand how risk aggregation, near-real-time visualization and analysis can change catastrophe modeling and risk management practices, and how you can better assess a policy in the context of the book-of-business; determine PML; visualize exposure; and allocate post-CAT event resources. Learn more |